30+ Mortgage Deduction Calculator

It reduces households taxable incomes and consequently their. A 30-year fixed-rate mortgage is the most popular loan type but its not your only option.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Web As outlined by IRS regulations single-file taxpayers and married couples filing joint taxes can deduct home mortgage interest on the first 750000 or 375000 if youre married.

. Web Principal paid 275520. Web The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in mortgage debt. Web In other words if your homeownership tax deductions combined with any other deductions are below the standard deduction 6300 for singles 12600 for.

Web With the mortgage tax deduction calculator you can get an idea of exactly how much youll be able to deduct from your taxes each year through your mortgage. The average interest rate for a standard 30-year fixed mortgage is 753 which is a growth of 753 basis points from seven days ago. You and your spouse file jointly.

Use this calculator to see how much you could save. Web The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Web Your mortgage has a term of 30 years and an annual percentage rate APR of 45 percent.

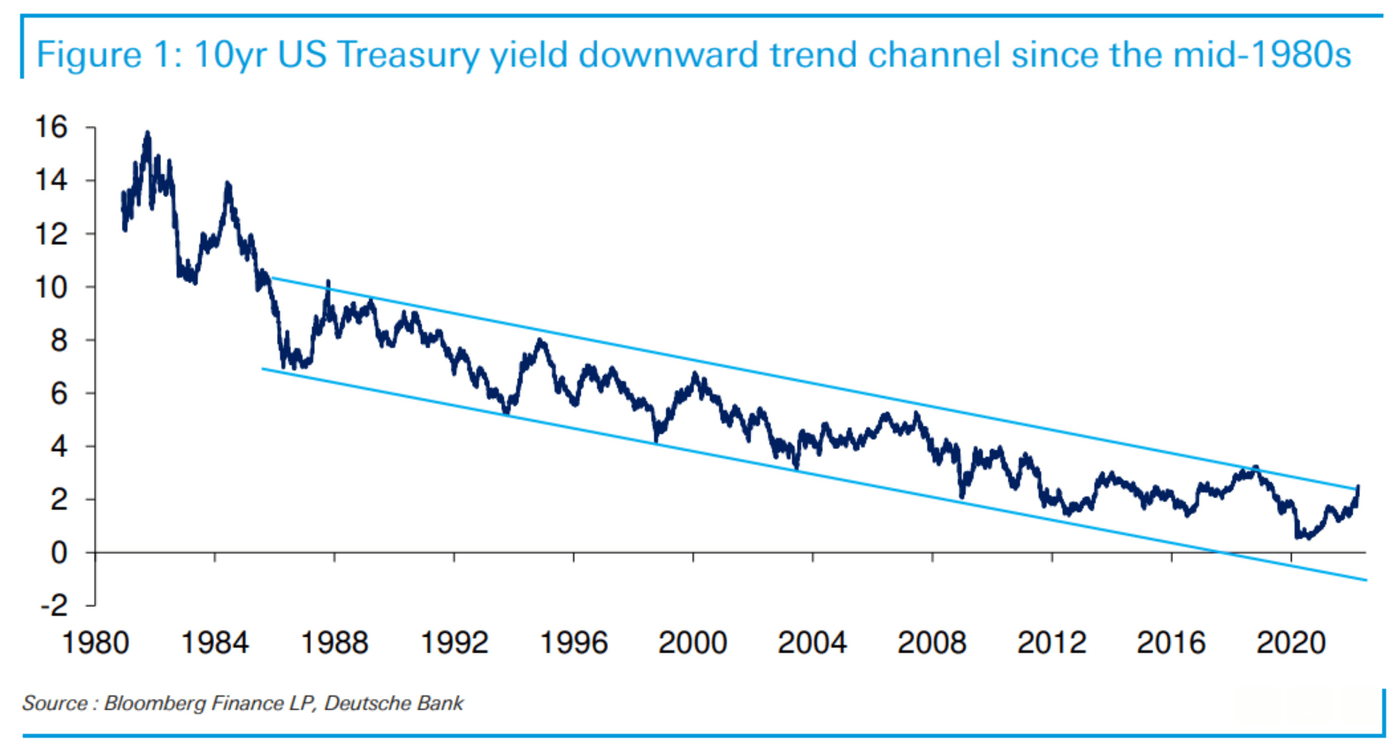

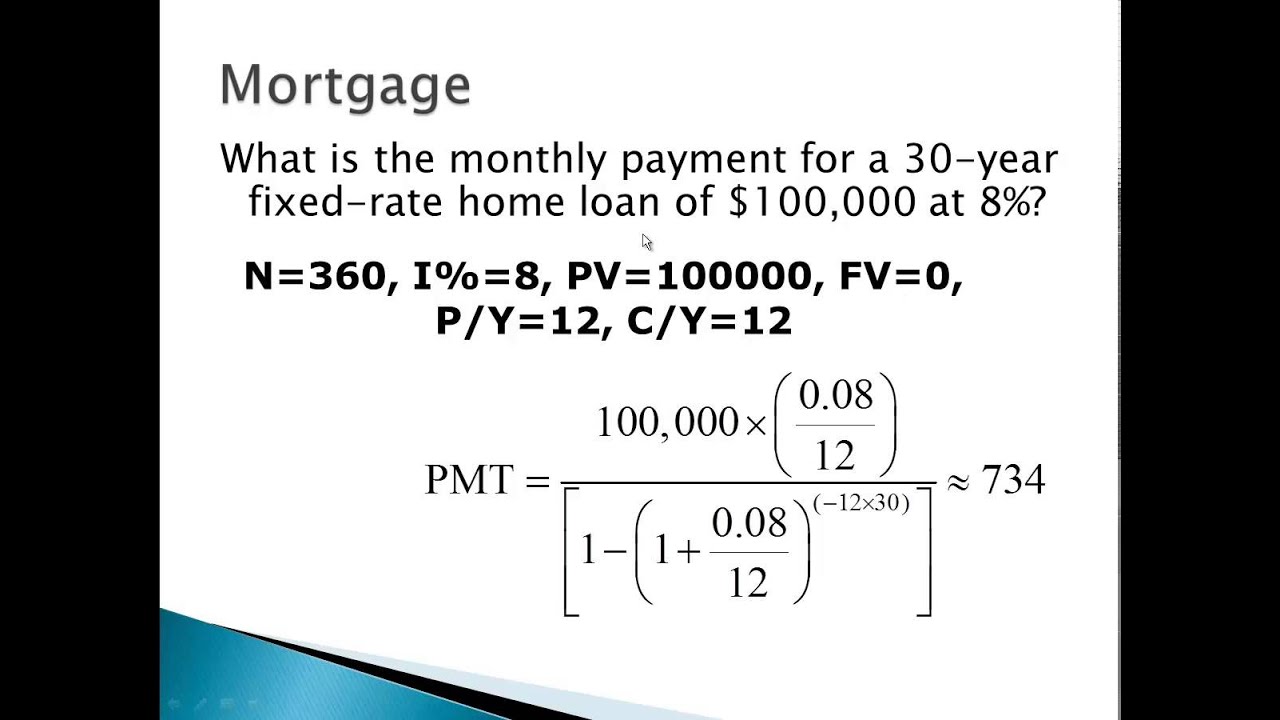

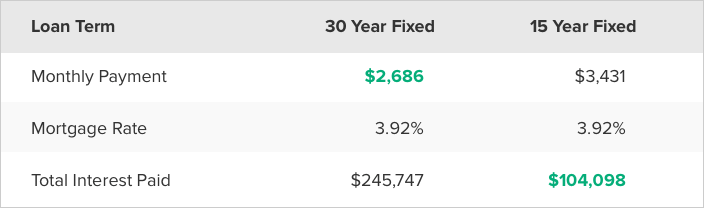

However if you bought a house after 2017 the maximum amount of interest payments. With todays interest rate of 764 a 30-year fixed mortgage of 100000 costs approximately 709 per month in principal and. Web Compare Mortgage Loan Term Lengths.

Web The mortgage-interest tax deduction does reduce the effective cost of these payments but it doesnt eliminate it. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web Before 2017 you can deduct the first 1 million interest payments from your mortgage.

Web Use this mortgage tax deduction calculator to determine your potential tax savings with a mortgage. Start Your MortgageCompare LoansSkip the BankCalculate Payments. Paying a 25 higher down payment would save you 891608 on interest charges.

The 2017 tax law signed by Donald Trump reduced. Use a mortgage calculator to see how. Web APR is the all-in cost of your loan.

Ways you can save. We will assume the following details. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 of their loan principal.

Web 30-year fixed-rate mortgages. 455 681 reviews. 9386 As you can see as time goes by you.

Mortgage Tax Deduction Calculator Loan amount eligible for interest. Start Your MortgageCompare LoansSkip the BankCalculate Payments. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Income Tax Calculator Find Out Your Take Home Pay Mse

Mortgage Calculator General Hvac R Solar

Home Mortgage Interest Deduction Calculator

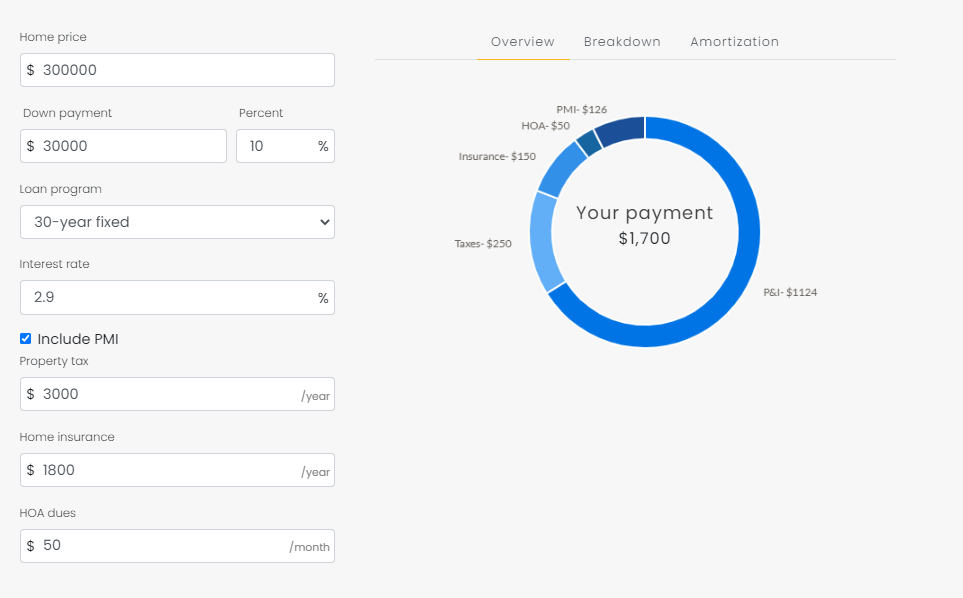

Mortgage Calculator Pmi Interest Taxes And Insurance

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Income Tax Calculator Find Out Your Take Home Pay Mse

Reverse Mortgage Calculator

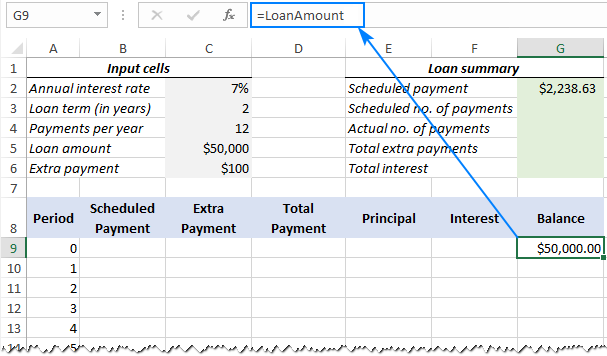

Create A Loan Amortization Schedule In Excel With Extra Payments

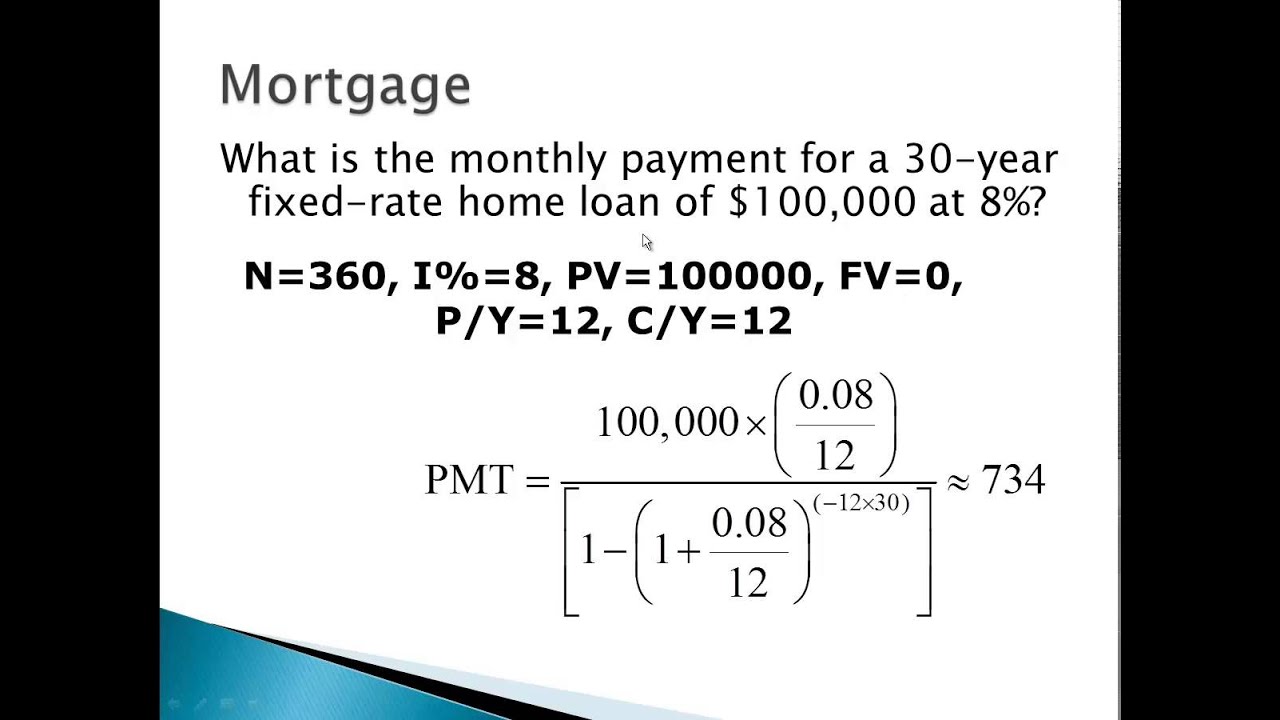

Mortgage Calculation Example Youtube

Overpaying With Nationwide Or Save Elsewhere Moneysavingexpert Forum

Five Years On What Impact Has The Phasing Out Of Mortgage Interest Tax Relief Had

Mortgage Tax Deduction Calculator Freeandclear

How To Use A Mortgage Calculator Jet Homeloans

![]()

Know Your Rights Unemployment Benefits In Germany In 2023

Mortgage Tax Deduction Calculator Equity Resources

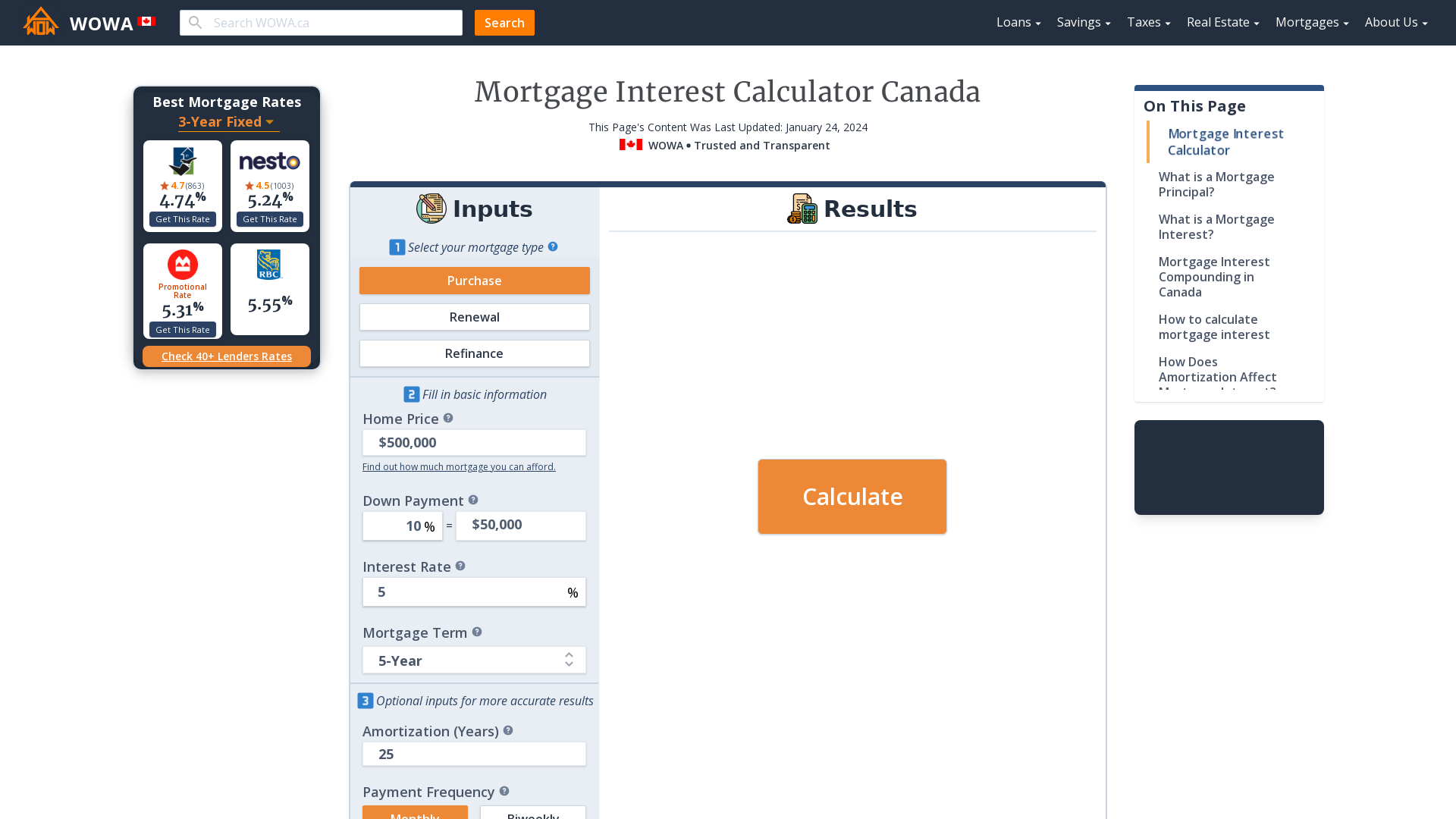

Mortgage Interest Calculator Principal And Interest Wowa Ca