51+ what percent of gross income should go to mortgage

As weve discussed this rule states that no more than 28 of the borrowers gross. Web The 2836 is based on two calculations.

What Percentage Of Income Should Go To Mortgage

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Ad Compare More Than Just Rates. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

In addition to mortgage. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The 3545 model. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

John in the above example makes. Ad Compare More Than Just Rates. Web What Percentage Of Your Monthly Income Should Go To Mortgage A general rule of thumb for homebuyers is your home loan should eat up no more than.

Ad Award-Winning Client Service. Find A Lender That Offers Great Service. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Save Real Money Today. Some applicants get approved with DTIs or 45. Web The Rule states that a household should not spend more than 28 percent of its gross monthly income on housing-related expenses.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. But thats a very general guideline. Apply Start Your New Home Loan Today.

Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. So if your gross. Web Most lenders look for a maximum DTI of 40 on applications for most sorts of mortgages.

Web The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt. However how much you. Find A Lender That Offers Great Service.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. A front-end and back-end ratio. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance.

What Percentage Of Income Should Go To Mortgage

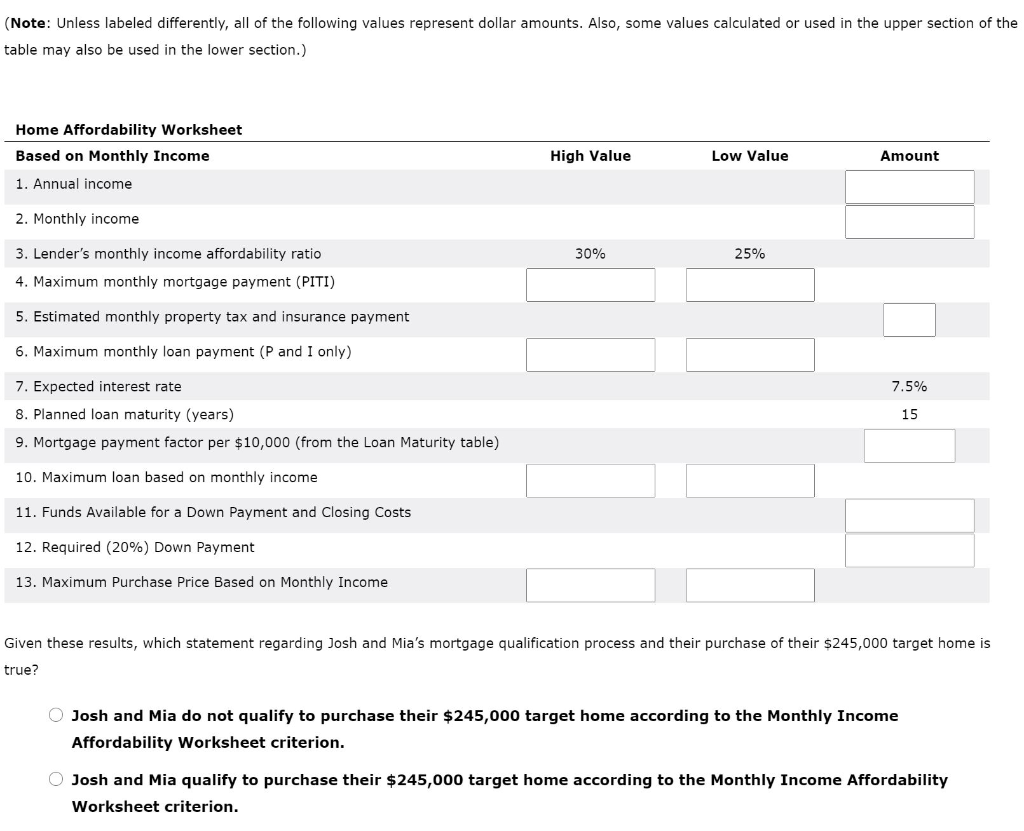

Sustainability Free Full Text Identifying Vulnerable Households Using Machine Learning

Explaining The Bundesliga S 50 1 Rule World Football Faq Bundesliga

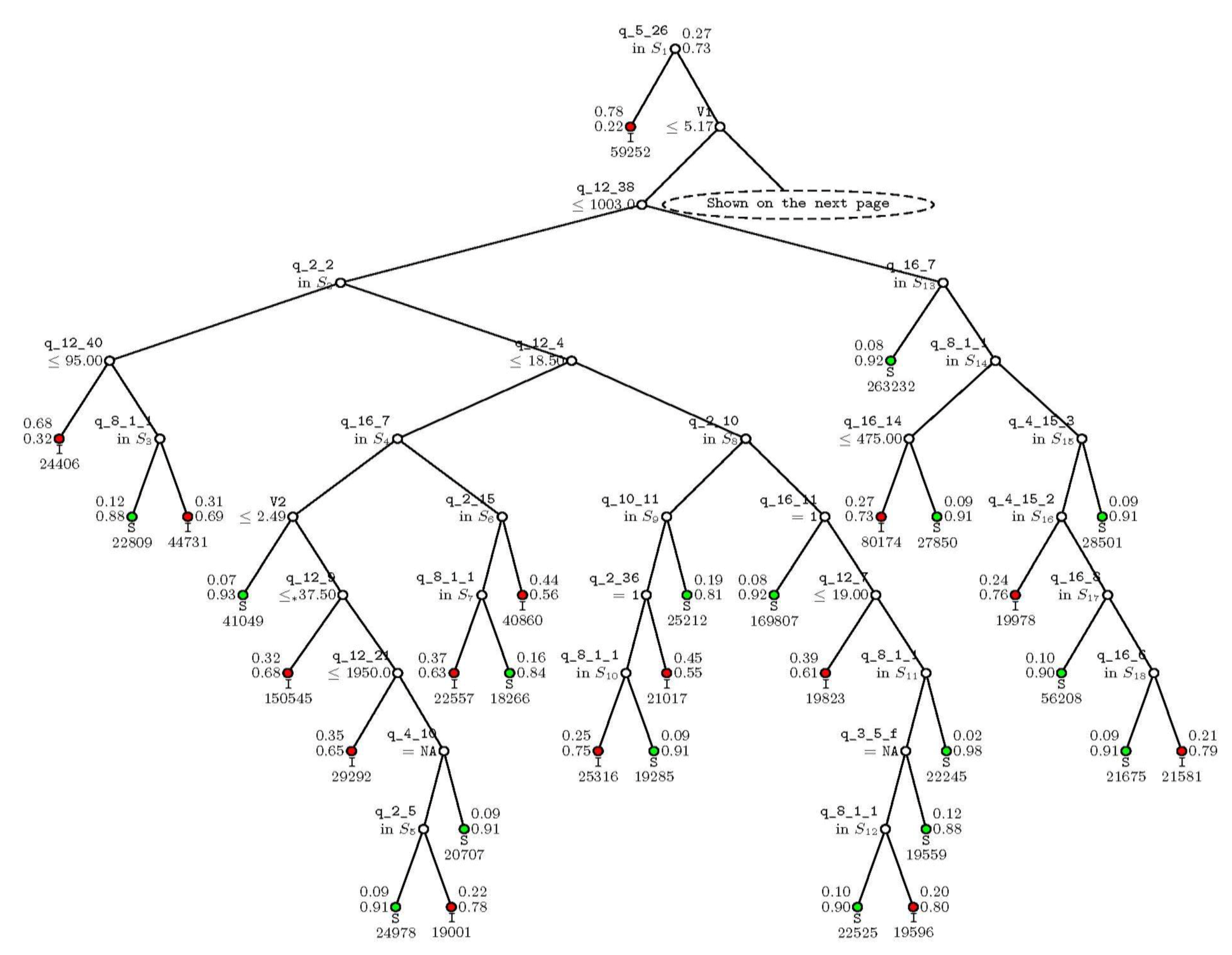

What Percentage Of Income Should Go To Mortgage

Business Succession Planning And Exit Strategies For The Closely Held

How Much House Can I Afford Moneyunder30

What Percentage Of Your Income Should Go To Mortgage Chase

Franchise New Zealand Year 27 Issue 03 Spring 2018 By Franchise New Zealand Issuu

What Percent Of Income Should Go To My Mortgage

How Much House Can You Afford Readynest

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go To Mortgage

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

How Much House Can You Afford Readynest

Retirement Wikiwand

What Percentage Of Income Should Go To Mortgage

Understanding Financial Consumersretail Banking Digital Banking Omn